AI-Powered Insights. Underwriter-Focused.

PointPal adds a clear, structured summary page to each PointServ bank statement package to support efficient review.

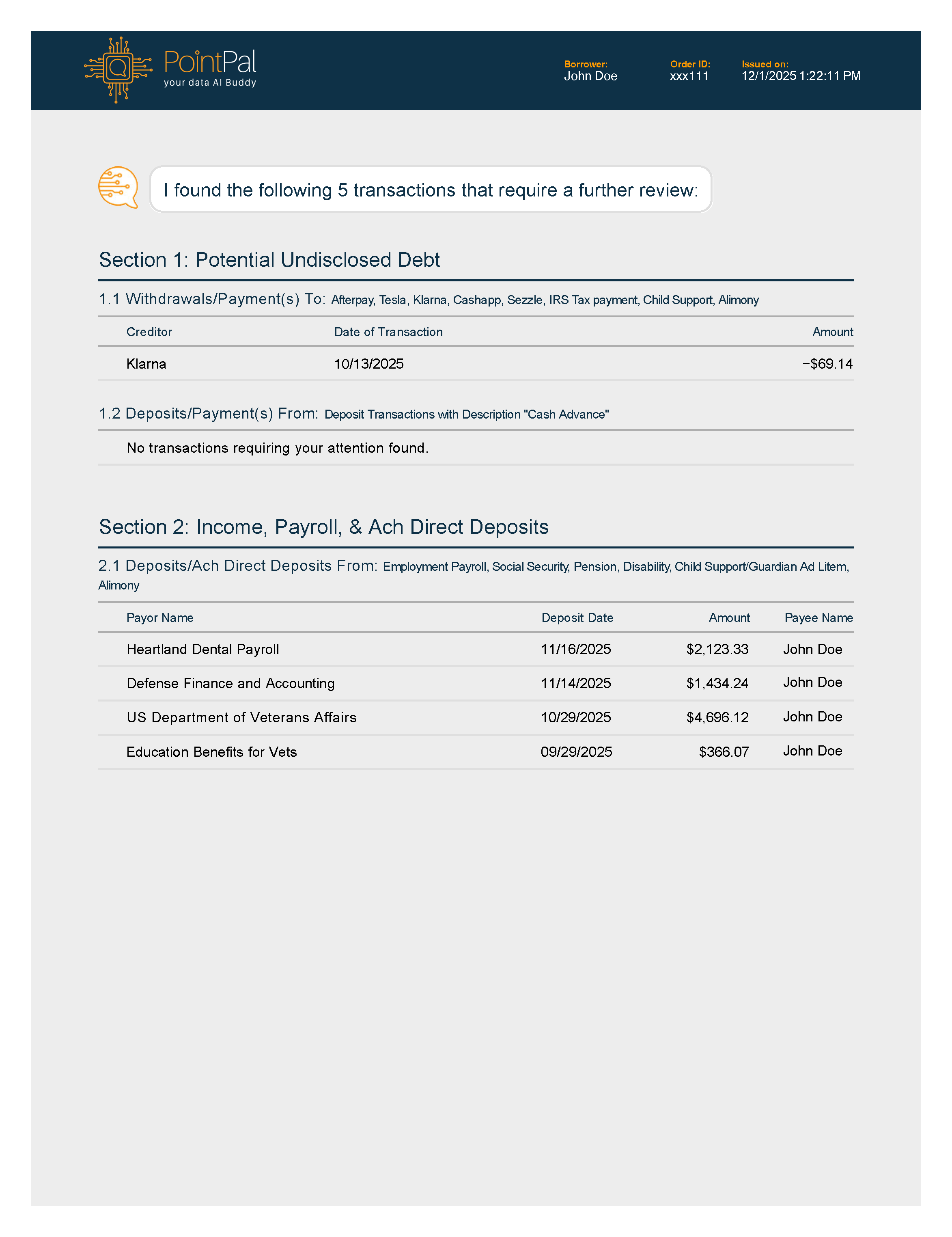

Identify Transaction Patterns That May Indicate Ongoing Financial Commitments

PointPal analyzes bank transaction data to surface recurring or high-risk payment patterns that may warrant further lender review, including:

- Buy Now, Pay Later Activity

Transactions associated with installment-style payment providers such as Affirm, Afterpay, Klarna, and Sezzle. - Non-Traditional Auto-Related Payments

Recurring vehicle-related payments that may not appear on standard credit reports. - Short-Term Liquidity Events

Patterns consistent with overdraft transfers, short-term advances, or similar cash-flow activity. - Government or Court-Related Payments

Transactions that may reflect tax-related or legally mandated payment activity.

PointPal does not determine creditworthiness or produce a consumer credit report. All insights are provided for lender consideration and verification.

Income Activity Overview

PointPal analyzes consumer-permissioned bank transaction data to surface recurring deposit activity that may be relevant to income review, helping underwriters quickly understand observed cash-flow patterns, including:

- Employment-Related Deposits

Recurring direct deposits commonly associated with payroll from employers. - Government Benefit Deposits

Deposits consistent with Social Security or similar benefit programs. - Retirement and Pension Distributions

Recurring deposits associated with pension or retirement income sources. - Disability-Related Deposits

Deposits that may reflect disability benefit payments. - Support-Related Deposits

Deposits that may be associated with child support or guardian-related payments. - Alimony-Related Deposits

Recurring deposits that may indicate alimony payments.

All income signals are provided for lender review and borrower verification and do not constitute income determination or certification.

Reduce Manual Review Time

PointPal organizes and highlights relevant transaction activity, helping underwriters spend less time manually scanning line items and more time focused on review and validation, resulting in:

- Faster access to relevant transaction patterns

- Reduced time spent locating potentially relevant activity

- More efficient review workflows and follow-up